According to Burning Glass, a job boards analytics company, five years ago, just 12 percent of dental laboratory technician positions required a college degree, today, 33 percent do. Five years ago 43 percent of farm product buying and purchasing agent positions required bachelor's degrees, today 77 percent do. Other occupations including cargo agents, insurance adjustors, and engineering technicians have all seen similar degree inflation during the recession.

"Degree inflation comes both from employers trying to better filter resumes,

but also from the growing technical requirements of many positions," says Rob

Romaine, president of MRINetwork. "A draftsman used to need to

go to a technical school to learn how to translate an architect's designs into

blueprints with a pencil and a ruler. Today, that position requires the use of

computer-aided design software, and understanding of architecture, mathematics,

science and technology. And increasingly frequently, a bachelor's degree in

architectural drafting and design too."

"Degree inflation comes both from employers trying to better filter resumes,

but also from the growing technical requirements of many positions," says Rob

Romaine, president of MRINetwork. "A draftsman used to need to

go to a technical school to learn how to translate an architect's designs into

blueprints with a pencil and a ruler. Today, that position requires the use of

computer-aided design software, and understanding of architecture, mathematics,

science and technology. And increasingly frequently, a bachelor's degree in

architectural drafting and design too."The portion of job postings for architectural drafters requiring a bachelor's degree has grown from 41 percent to 56 percent over the last five years according to Burning Glass.

The unemployment rate for bachelor's degree holders has fallen from 5 percent in late 2010 to 3.8 percent in November and it is just one small indicator of a lack of available professional talent. While more jobs may require bachelor's degrees, employers are also seeking candidates with more experience, something not necessarily obtained along with a degree. For those between 20 and 24 years old who want work, which includes recent college graduates, the unemployment rate is 12.7 percent, nearly twice the 6.5 percent unemployment rate for those over 25 years old.

"In general, unemployed bachelor's degree holders are younger, less experienced, and less likely to be a match for the most critical mid-career vacancies," says Romaine. "While there are clearly exceptions to this profile, finding the exceptions is one of the hardest parts of hiring in this economic environment."

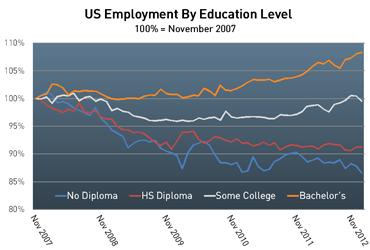

Even while the economy has been growing over the last year-albeit slowly-the impact on employment levels for those with lower levels of educational attainment has been devastating. Total employment for those without any college experience has fallen by 535,000 jobs in the last twelve months. For those with college experience, however, total employment has grown by more than 2.5 million positions, with 1.9 million of those jobs going to bachelor's degree holders.

"For a company's most critical positions you have to hire someone who already has the education, skills and needed experience on day one. For many roles there is little room for on the job training and if there isn't an internal promotion possible, they will have to hire from the open market. That open market is a candidate pool which even in a struggling economy is extraordinarily tight," says Romaine.